Time is money when you’re under constant pressure to place more capital. But normalizing data and digging through emails takes work. To balance the demands, you need technology that can adapt to your unique workflows, policies and reporting functions. That’s RealINSIGHT. Cloud-based CRE software that integrates your proprietary Excel models, naming conventions and custom reports to help you cut through the noise and put your money to work faster.

Supercharge Your Excel

Most CRE platforms want to replace your Excel. Not RealINSIGHT, we love Excel! That’s why we made it an extension of our system. RealINSIGHT maps your workbook against the data dictionary, making it available how and when you want to view it. We even support updates.

Manage the Workflow

With RealINSIGHT, you can create custom workflows that help everyone follow the right steps for underwriting projects. This means your teams always know what’s happening on current and future projects.

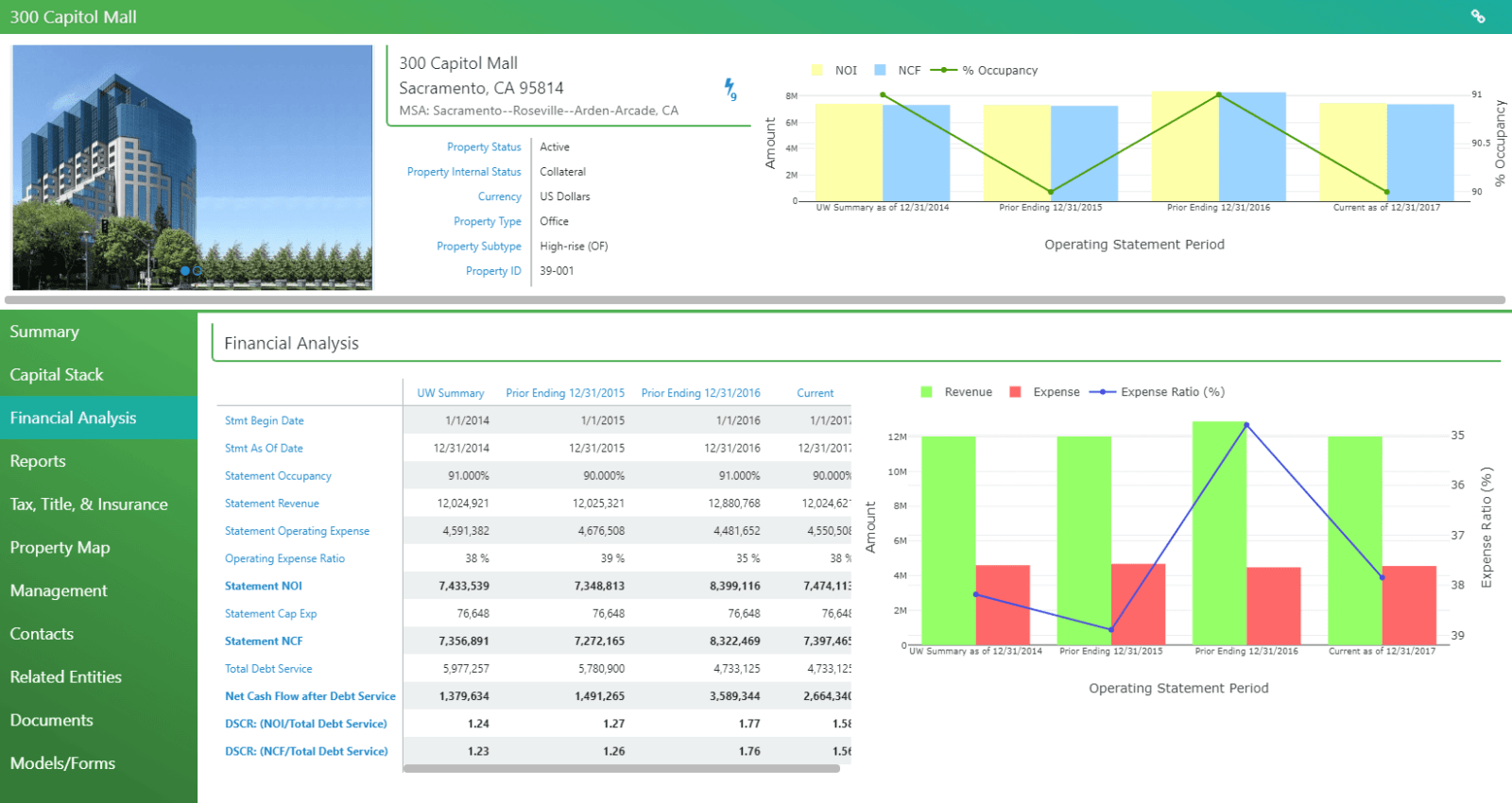

Turn Data Into a Competitive Advantage

RealINSIGHT captures the full history of every opportunity so anyone with permission can view the entire narrative. This includes different versions of the analysis and each iteration of the model. So, even if the deal doesn’t happen, you have the data in the right place. This helps you build up a dataset for a competitive advantage on future transactions.