Investors, clients and management have different goals, strategies and boundaries. And every day, they want capital placed with speed and precision. To balance these demands, you need technology that can work with your processes – which are custom and a competitive advantage. That’s RealINSIGHT. Cloud-based CRE loan origination software that adapts to your business.

Your CRM is NOT a CRE Loan Origination System

Brokers and your interactions with them are critical to loan origination. But too many lenders and debt investors rely on their CRM to keep track of information and communication. This leads to lost data, missed opportunities and business that won’t scale. RealINSIGHT helps you track deal sources, contacts, meetings and statuses and assign them to a proposal. Now you have that information for managing and reporting on the entire lifecycle of a deal.

Shape Your Investment Strategy

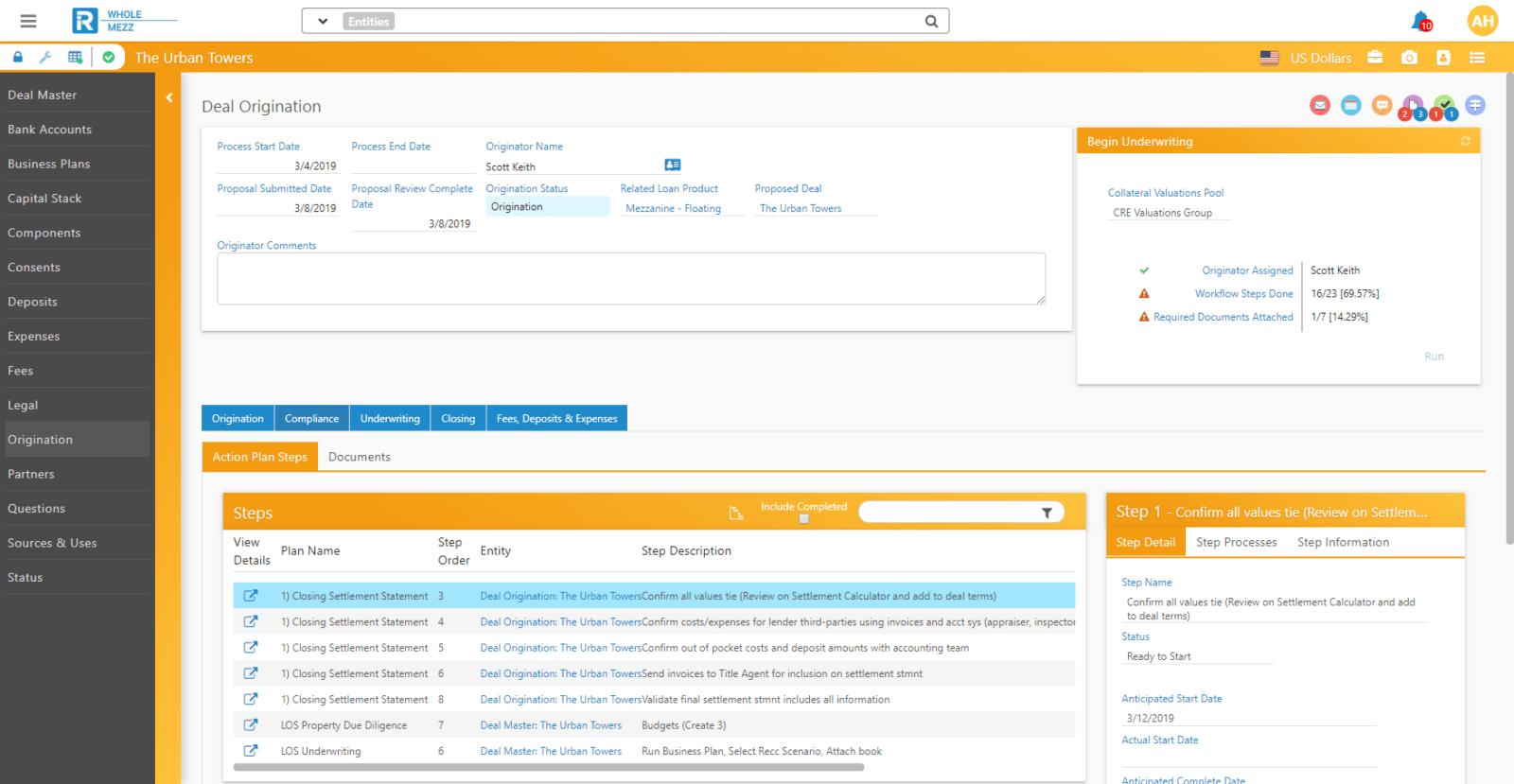

RealINSIGHT lets you configure the origination system to match the products you sell with their funding sources. This helps you evaluate every deal against the exact requirements of investors, clients and management. And also screen each deal for the borrower, collateral and terms that work for you and your customer. As you fit each proposal to a product and funding source, all your predefined exhibits, models and workflows come into play; automatically ensuring the balance of the portfolio is maintained while enforcing compliance.

Capture the Full Narrative

When it’s time to do the deep dive into underwriting and due diligence, you’ll find RealINSIGHT has you covered. Capture property appraisals, BOVs, inspections, insurance, rent rolls, operating statements and budgets. Construct loan term scenarios together with operating budgets to test covenant compliance, extension eligibility, future funding disbursements and develop a loan cash flow return projection. Create and generate the ASR you and your management want.

As you move through the process, RealINSIGHT will make sure the proper workflows and approval routes are generated and distributed to your teams. All of these capabilities are there for the closing process, too.

Answer High-Level Questions

With details flying around, it can seem hard to put everything into perspective. How are you supposed to know what’s going on at a high level? A key feature of RealINSIGHT is every field can be added to custom reports. Use the reports you create to make charts, graphs and stratifications that can be added to dashboard pages giving users the ability to drill into the detail of any slice. Imagine creating a dashboard for senior management that answers their questions about the pipeline at macro-level and lets them explore deal specifics right from there.

Benchmark Future Deals

For the rest of your organization, the close is just the beginning. That’s why everyone will be glad you have RealINSIGHT. All your work – the models, documents, rent rolls, cash flows, and narrative – it’s all there for asset management to use as a performance benchmark. You can follow along and see the performance of the deals over time. As you learn more about the performance of each product, you can go back and adjust its profile to bring new deals more in line with expected return benchmarks.