Uncertainty is a fact of life for commercial real estate lenders in the age of coronavirus. In this post, we’ll take a close look at whether insurance coverage can help soften the blow taken by sectors like hospitality and retail.

Imagine this hypothetical scenario: Your collateral consists of a 200-key limited service hotel in a major MSA. Reservation cancellations, of course, have been abundant due to the ongoing pandemic. Management wants you to recast your Q1/Q2 2020 revenue estimates, and they’re wondering whether insurance might blight some losses. After all, some companies were able to receive insurance recoveries in the wake of 9/11, even though their properties were not directly damaged.

The answer, for better or worse, depends on a myriad of factors. Here’s how to dive deep into your particular situation and gain clarity on the issue.

Start with Your Loan Insurance Covenant Requirements

Most commercial loans require the borrower to obtain a scope of insurance policies that include coverage for buildings, business personal property and loss of rents. The loan provision defines the minimum perils that are required to be insured by the policy. You will usually see wording along the lines of: “insurance against loss or damage by fire, wind (including named storms), lightning and such other perils as are included in a standard ‘all risk’ or ‘special form’ policy.”

Insurance requirements typically go on to mandate coverage for flood, builders’ risk, ordinance or law, machinery breakdown, auto, workers compensation, commercial liability, pollution liability, and other exposures. But nowhere in a typical loan covenant is there a specific requirement for “Communicable Disease.” Even exposures to “pollution” require a Phase I/II inspection, as well as a finding of condition.

Review the Insurance Policy for Exclusions

Most of us would assume that an “all risk” policy would cover all perils, right?

Well, not so fast. Many insurers stopped using the phrase “all risk” years ago. In its place, they substituted wording such as “special causes of loss,” “basic cause of loss,” or “broad causes of loss.” This means not everything will be covered, even in an “all risk” policy.

To figure out what’s not included in your coverage, you should investigate the exclusions, conditions and endorsements sections.

In most commercial property policies, you will find that there is no reference to disease. However, you will likely find an exclusion for “pollution.” If a pollution exclusion is present, determine if it includes fungi, mold, bacteria, viruses, and/or microbial matter. If it does, then unfortunately COVID-19 related losses are almost certainly not covered.

Every policy is different, so you should diligently review yours.

Once you confirm that your SPE is named on the policy, your location is listed as a covered location, and the peril that caused the loss is not excluded, you will need to verify that the loss was a direct physical loss from an insured peril.

For instance, if your hypothetical hotel was contaminated, condemned or quarantined by civil authority due to an outbreak, you would certainly have experienced an income loss. However, absent the insured peril it may be difficult to substantiate a claim for loss of revenue needed to trigger coverage.

Check for Cancellation of Bookings Coverage

As you may have concluded, property insurance policies would not usually respond to loss of revenue related to cancellations as a result of the COVID-19 outbreak. After all, transmission of the virus is between people and does not involve damage or cleanup to physical property.

That said, some insurance buyers obtain limited coverage for loss of revenue associated with localized hotel business impact, assuming there was an outbreak at the hotel or within a specified distance. (This is usually under a Cancellation of Bookings coverage.) There are also other factors that would need to be satisfied to trigger coverage; these include restrictive travel advisories issued by the World Health Organization or comparable authority. Additionally, civil orders or ingress/egress issues that affect access to the property would need to be in place and reviewed.

However, such coverage is not standard. Usually, only large national hospitality firms elect to obtain it.

What About Post-9/11 Insurance Recoveries?

As previously noted, some properties did receive loss of earnings payments from insurers after experiencing revenue losses after the 9/11 terrorist attacks. These were often triggered even without physical loss or damage, and in the absence of specific cancellation coverage. So, what happened?

In this case, the insured had typically purchased a specialized form of coverage called “contingent business income” (CBI) or possibly “dependent properties time element coverage.” These are intended to pay for loss of income or increase in expenses resulting from damage to premises of other organizations.

If this is not in place in your policy, review for the points noted above. Is it an insured location? Is the damage due to an insured peril not otherwise excluded? (9/11 damage was due to an aircraft, for example, which is typically a covered peril.)

All of this begs a question: Can firms recover loss of income with no direct damage in today’s environment?

The answer is “maybe.” Loss of earnings payments from insurers other than specific cancellation coverage could be triggered, even though the recipient location did not experience direct physical loss or damage. The best chance of this happening in our hypothetical is when the policy includes a specialized form of limited coverage. If it does not, odds of recovery are likely slim.

Talk to Your Agent, Broker or Risk Manager

If you need to analyze your chances of an insurance recovery for lost revenue due to COVID-19, your first call should be to your insurance agent, broker or risk manager. They should review your policy in detail, looking for specialty coverage, exclusions, extensions and limits.

It is worth noting that we have been discussing only commercial property and associated time element insurance coverage, as manifest in typical commercial loans. Some specialty policies offer broader coverage and terms.

You may also want to review your:

- Workers Compensation Policy

- Commercial General Liability Policy

- Management Liability Policy

- Cyber Liability Policy

- Professional Liability / Errors & Omissions Policy

The first source for such questions and informed answers should be your insurance professional; they are trained to identify, quantify and offer solutions for emerging risks such as COVID-19. As with any property claim matter, the insurer always provides coverage position based on the facts of the loss and their own policy coverage review.

The Role Commercial Real Estate Software Can Play

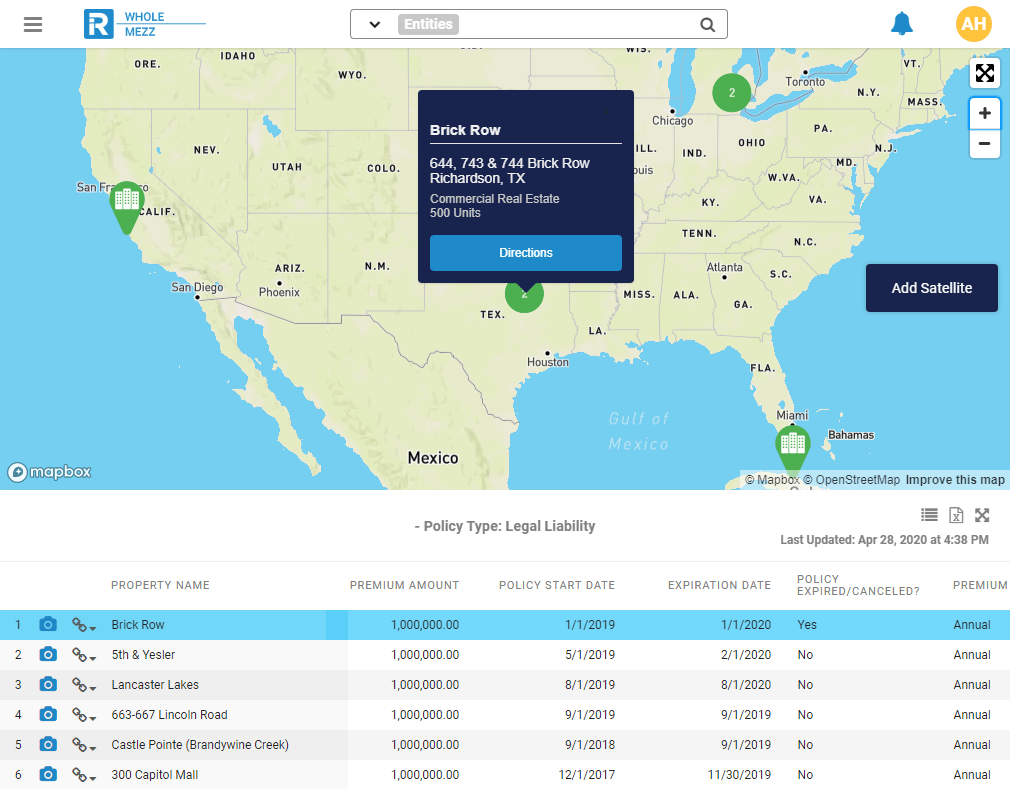

CRE asset management software, like RealINSIGHT, can play a critical role in helping review and assess your portfolio. You can geo-target assets, identifying “hot spots.” Likewise, you can add contact information of the insurance company to keep that information easily accessible in case of an emergency – all within the RealINSIGHT platform.

Some insurance policies will cover losses in this pandemic, and some will not. But by drilling down into your assets and keeping a constant eye on properties, insurance policies and pandemic hot spots in one central software, you will be best prepared for whatever comes next.

To help CRE professionals better respond to the current environment, RealINSIGHT is offering two free months access to our CRE lending & asset management platform. Get started here.