If there ever was a time to focus on technology to oversee your portfolio, this is it. The fallout from the COVID-19 outbreak is the latest example of CRE portfolio managers’ need to rapidly assess exposure to both broad and specific events.

Utilized by industry leaders, RealINSIGHT is the leading provider of this technology.

“In fast-moving events like a pandemic, it’s absolutely critical to uncover areas of risk proactively,” said David King, a Senior Vice President at CWCapital, an affiliate company of RealINSIGHT. “Using spreadsheets and legacy technologies pales in comparison to the comprehensive picture RealINSIGHT can provide. This modern technology has made it significantly easier to stay on top of how events like these can impact our clients’ portfolios.

“Almost as important, the team and I can use it from the office or from our homes.”

In this post, we’ll break down how the flexibility of the software makes it easy to understand and begin to mitigate portfolio risk, customized to the current situation. As we have learned, all economic cycles are not the same.

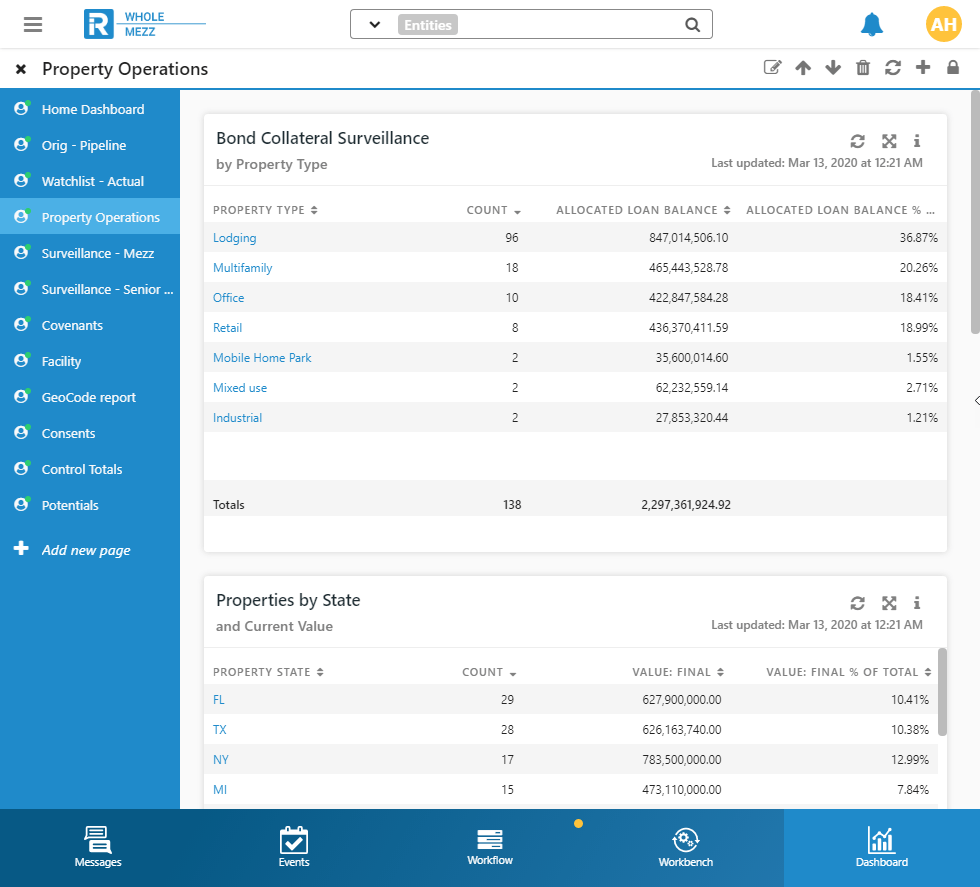

With RealINSIGHT, a portfolio manager can quickly open a dashboard to see an overall portfolio, broken down by property type. He or she can then drill down to data related to a particular property type.

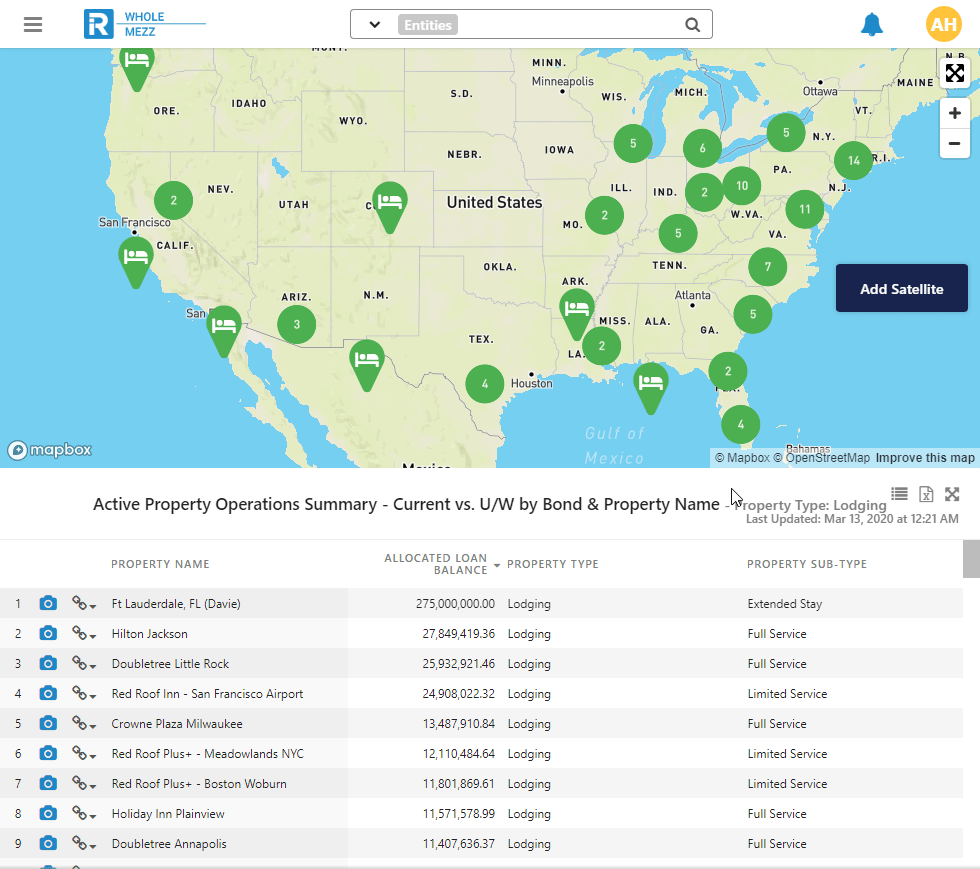

In the case of the coronavirus disease outbreak, the most immediately impacted asset class is Lodging. Some geographic areas may be hit harder than others. To better understand exposure, the PM can start their search with a visual interpretation of where concentrations lie:

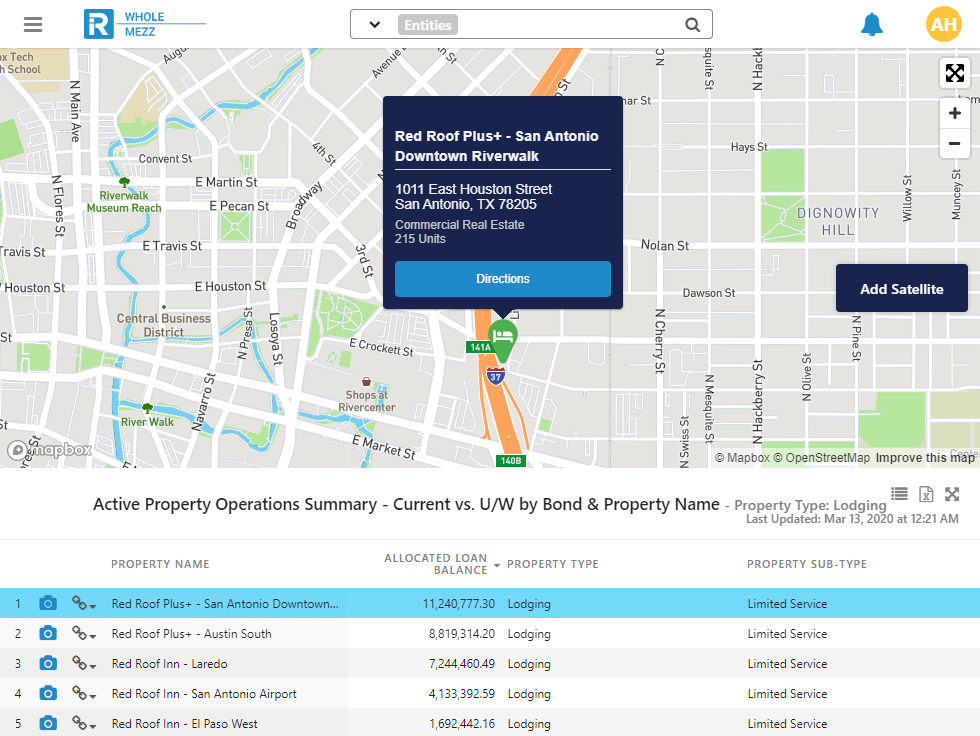

With an event like a pandemic, the question might become, “Where do I begin?” Certainly, every hotel has potential to be negatively impacted. Combining this with the recent drop in oil prices, one might focus a search on lodging outlets in oil-producing or oil-dependent areas, like the Permian basin or Houston.

RealINSIGHT’s sorting and filtering capabilities let portfolio managers easily access granular information like this. The table can be filtered by any data field to access targeted areas or sub-data sets (e.g., city, state, ZIP code, or client-drawn areas).

With a confluence of factors, RealINSIGHT helps identify and manage risk by isolating areas of concern, large or small.

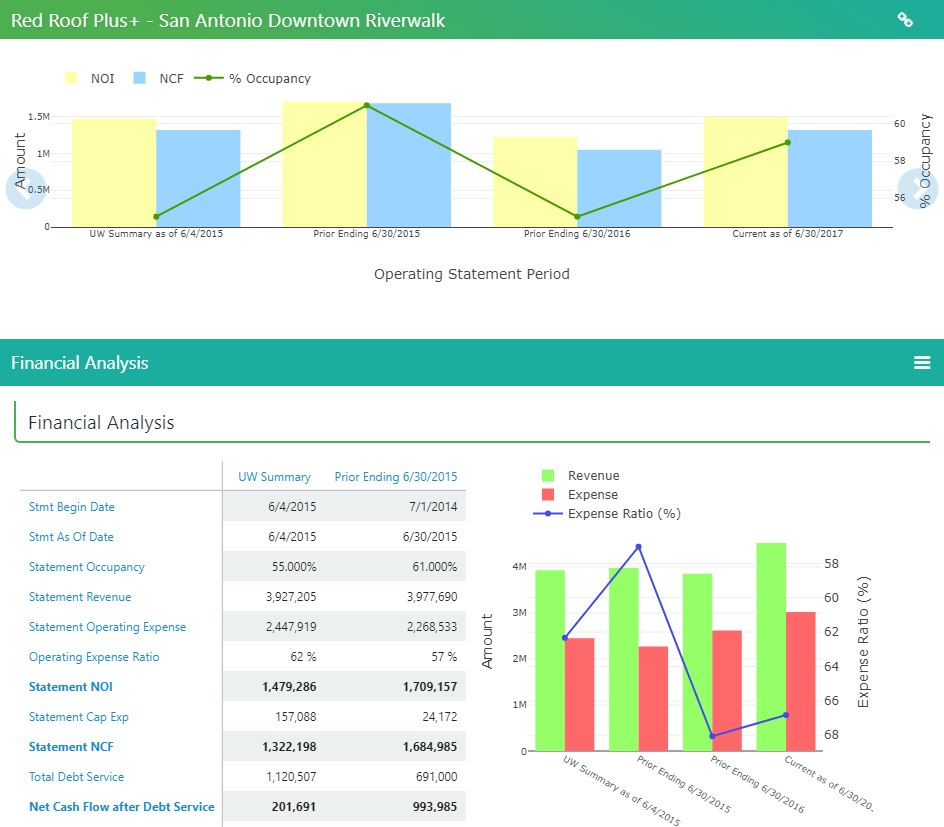

Further drilling allows a sorting of the subset by customizable categories and benchmarks. Low debt coverage, high debt yield and high leverage are three levers that the PM can deploy to sort the portfolio to assess where issue loans might be revealed.

From this filtering process the PM can begin asset level stress analysis. RealINSIGHT allows the PM stress actual performance to underwrite for the situation at hand.

RealINSIGHT is the leading solution for understanding a CRE portfolio in all parts of the economic cycle. We’d love to show you how it can help you weather any storm.