The current state of the world is a mess. Coronavirus. Stock market volatility. Rock-bottom oil prices. Interest rate cuts. It all seems to be happening at once. But there is something you can do about it.

In this post, we’ll discuss how you can use commercial real estate asset management software to proactively assess portfolio risk. RealINSIGHT’s risk rating models and watchlists automate monitoring, which allows you to address issues before they arise.

“We run monthly risk rating models as part of our routine surveillance services for clients,” said Daniel Warcholak, Managing Director at CW Capital, an affiliate company of RealINSIGHT. “Without technology, this would be extremely time-consuming. There are thousands of loans and hundreds of thousands of data points to track. RealINSIGHT makes it simple. With a few keystrokes, we can generate credit models and watchlists in minutes”.

Risk Rating Your CRE Portfolio

We recommend running a risk rating model on your entire portfolio at least once a month. With RealINSIGHT software, you can use your own models, or you can choose from a set of off-the-shelf Excel models.

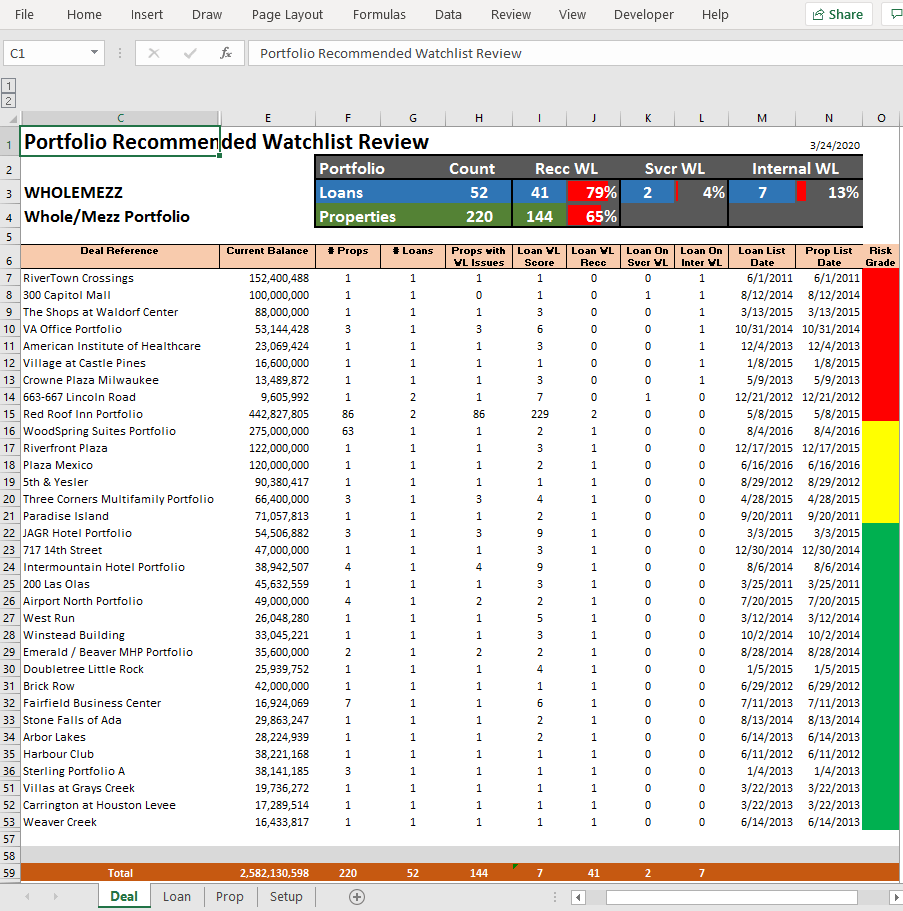

The above example is one of the most popular risk reports. It uses a simple Red-Yellow-Green ranking to denote different levels of risk. Red is the highest, and green is the lowest. Organizations can easily set up their own inputs, which act as drivers for the model.

For instance, flags like these are often used to risk rate a portfolio with exposure to lodging/hospitality assets:

- Airport Hotels (near airports and/or have large airline contracts)

- Business Centers (have large convention center spaces)

- Destination Hotels (e.g., Disney resorts)

- Hotels in Oil/Fracking Regions (e.g., Permian Basin)

Once a baseline model is set up, it can be run monthly after remittance reports and operating data is received from borrowers and servicers. This automatically creates a standardized portfolio risk score.

It’s good practice to have a standard set of risk rating inputs. This allows anyone with the correct permissions to generate reports at any time. That said, RealINSIGHT was designed to be flexible. Any inputs can be further customized and adjusted as situations change.

Create Your Own Watchlist

In this challenging climate, you cannot wait on borrowers, property managers or servicers to let you know there’s a problem. You need to get ahead of issues by flagging potential risks as far in advance as possible. This allows you to take necessary precautions.

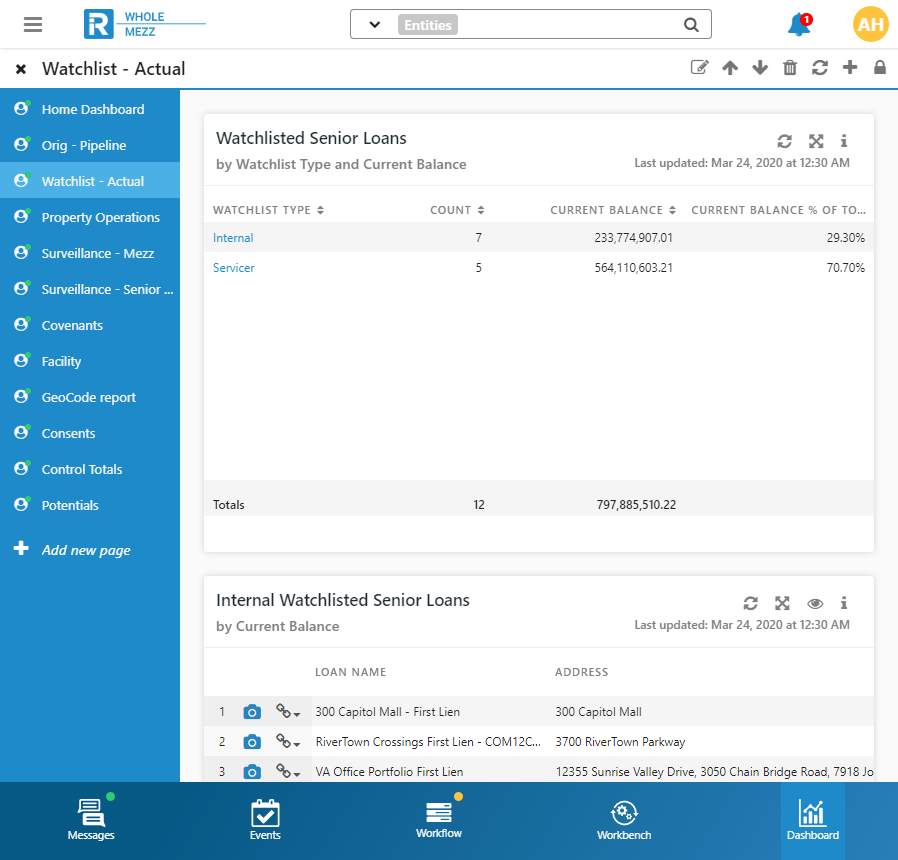

Your most at-risk assets can be identified by running a risk rating model, then placed onto a “watchlist.” This can be used as a standalone dataset or aggregated with other watchlists generated by the various servicers. This ensures nothing slips through the cracks.

Deep Dive into At-Risk Assets

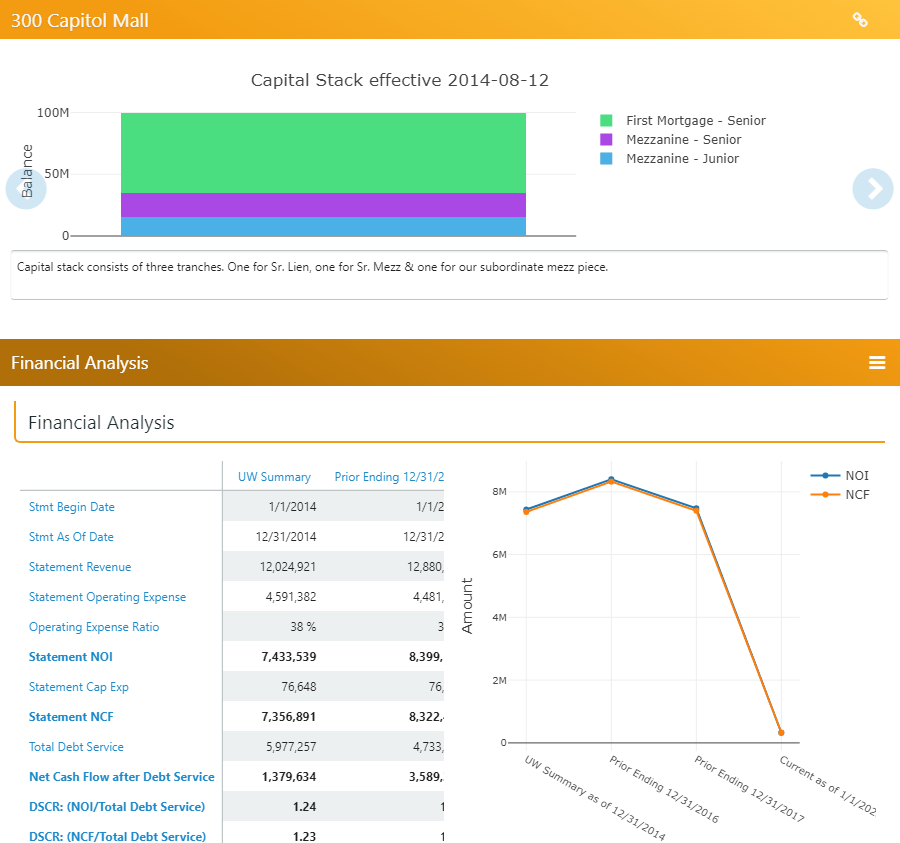

Once watchlists are created, they can be used as guides for which loans and underlying collateral should be further analyzed. After the target list of assets is narrowed down, you can run scenarios against the original underwriting to stress different assumptions.

We know you have investors, clients and management who are all asking for answers. And they expect them yesterday! Technology and automation that fit your processes, naming conventions and organizational structure are ideal solutions.

In order to stay ahead of risk, we recommend running standardized risk rating models regularly. These should feed into updated watchlists to allow for further analysis and evaluation. This guidance applies to any CRE loan product: bridge, Freddie, CMBS, construction, mezzanine, etc.

If you’re an existing RealINSIGHT client, we’d be happy to help you set up risk models and watchlists. Simply contact us for assistance.

If you’re new to RealINSIGHT, we can set up a virtual demo.

These are challenging times. One way to stay ahead of the game is to proactively assess portfolio risk. Let our surveillance and asset management software do the work for you.